Ai Tools

Best AI Sales Tools for SDRs in 2026: Complete Tech Stack Guide

The ultimate SDR tech stack guide for 2026. Compare 20+ AI sales tools across data, personalization, engagement, and automation. Build the perfect stack for your team size and budget.

LeadSpark AI Team

18 min read

Building a modern SDR tech stack in 2026 isn't about collecting tools—it's about aligning them to drive predictable revenue.

The problem? The average sales team uses 15-20 different tools, and 66% of sales reps say they're overwhelmed by their technology. Meanwhile, companies using AI-powered sales tools see 20% higher sales ROI and up to 50% faster pipeline growth.

This guide breaks down the 20+ best AI sales tools for SDRs in 2026, organized by category, with real pricing data and tech stack recommendations by company size. Whether you're a solo SDR or managing a 50-person team, you'll know exactly which tools to stack—and which to skip.

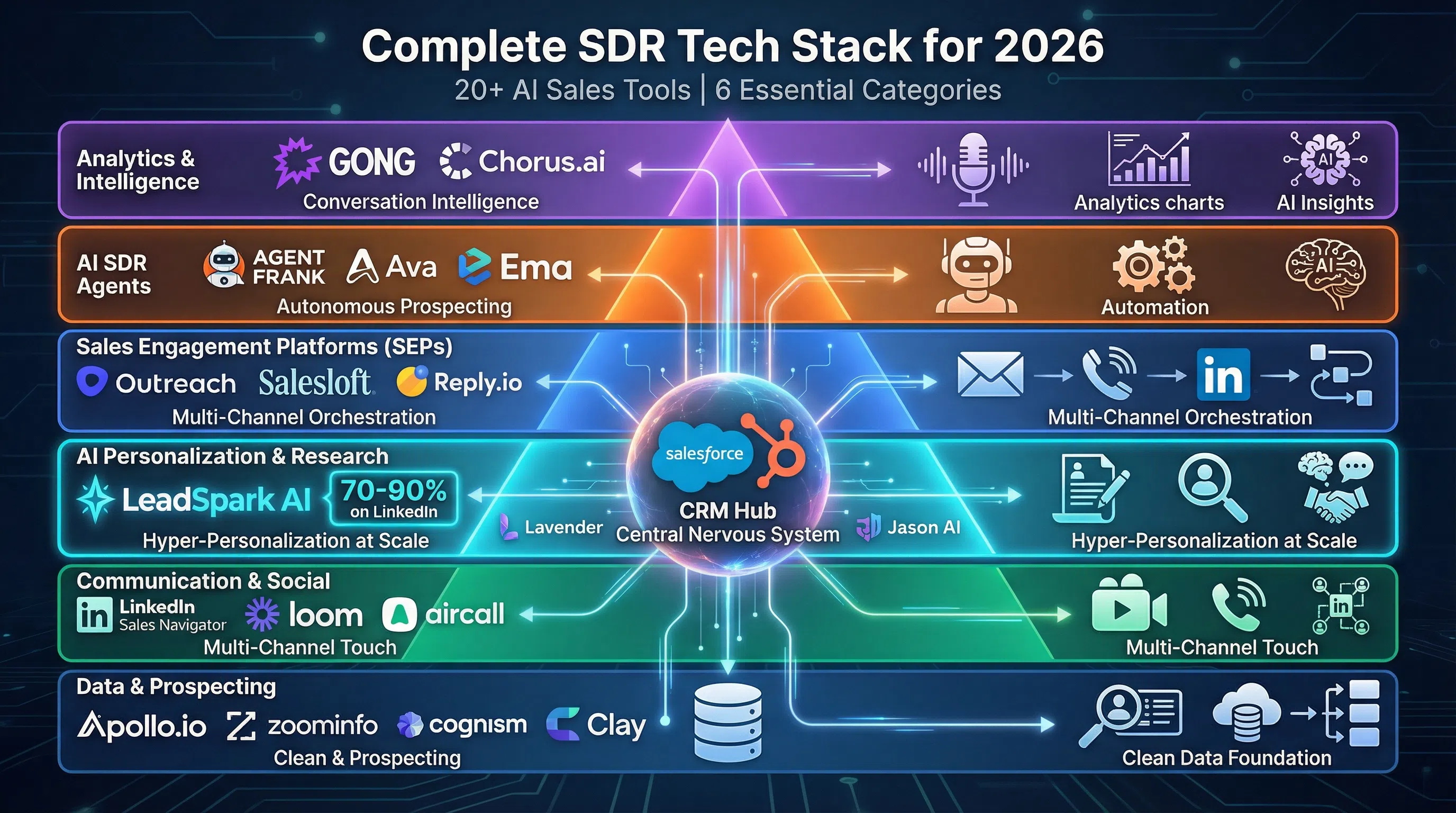

The Modern SDR Tech Stack: 6 Essential Categories

Before diving into specific tools, here's how to think about your SDR tech stack in 2026:

- Data & Prospecting: Find and enrich leads (Apollo, ZoomInfo, Cognism, Clay)

- AI Personalization & Research: Craft hyper-personalized outreach at scale (LeadSpark AI, Lavender, Jason AI)

- Sales Engagement Platforms: Orchestrate multi-channel sequences (Outreach, Salesloft, Reply.io)

- AI SDR Agents: Autonomous prospecting and outreach (Agent Frank, Artisan, Ema)

- Communication Tools: Video, calls, and social selling (Loom, Aircall, Sales Navigator)

- Analytics & Intelligence: Call recording, conversation analysis (Gong, Chorus)

Your CRM (Salesforce, HubSpot, or Close) sits at the center as the "central nervous system" of your sales operation.

Category 1: Data & Prospecting Tools

The foundation of any SDR stack. As one SDR manager put it: "I would break the bank on data if I had to" — because without clean, accurate data, every other tool in your stack fails.

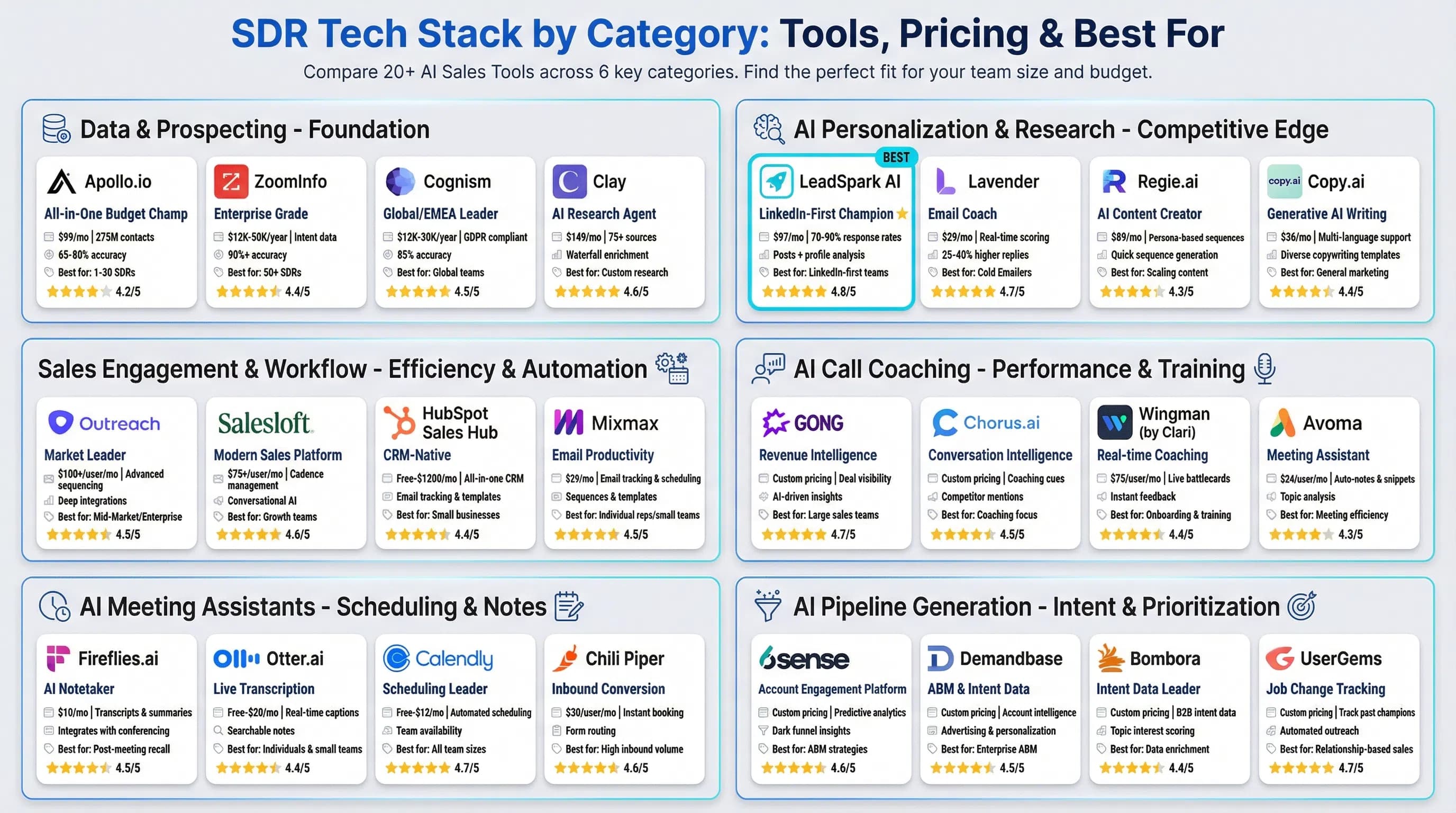

Apollo.io: Best All-in-One for Budget-Conscious Teams

What it does: Combines 275M+ verified contacts with sequencing and engagement workflows in one platform.

Key features:

- B2B database with email, phone, and direct dial data

- Multi-channel sequences (email, calls, LinkedIn)

- AI-powered personalization and deliverability optimization

- Built-in dialer and email sender

Pricing: Free tier available; paid plans from $99/month

Best for: Small to mid-sized teams wanting an affordable all-in-one solution

The reality: Users report 65-80% data accuracy vs. enterprise tools' 85%+, but at 1/10th the price. One user noted that while ZoomInfo's $35K-50K package was "too much," Apollo's $99/month plan "paid for itself".

ZoomInfo: Best for Enterprise Teams with Complex Sales Cycles

What it does: Enterprise-grade B2B database with deep company intelligence and buyer intent signals.

Key features:

- Intent data showing which accounts are actively researching

- Technographics (what tools companies use)

- Org charts and buying committee mapping

- AI Copilot for intelligent prioritization

Pricing: Custom pricing; typically $12K-50K annually (no public pricing)

Best for: Enterprise sales teams with 6-12 month sales cycles

The reality: ZoomInfo requires substantial upfront investment and only sells annual/multi-year contracts. The data quality is excellent for US markets, but you're paying for features most SDRs don't need.

Cognism: Best for Global Coverage (Especially EMEA)

What it does: Globally compliant B2B database with particular strength in European markets.

Key features:

- Diamond Data® (phone-verified mobile numbers)

- GDPR and CCPA compliance built-in

- Strong coverage in EMEA, NAM, and APAC

- Intent data and technographics

Pricing: Custom pricing; typically $12K-30K annually

Best for: Companies selling into European or global markets

The reality: Data accuracy closer to 85% vs Apollo's 65-80%. If you're selling globally, especially in Europe, Cognism's compliance features and regional coverage justify the premium.

Clay: Best for AI-Driven Research and Enrichment

What it does: AI research agent that connects to 75+ data sources to build and enrich prospect lists automatically.

Key features:

- Connects to ZoomInfo, Apollo, LinkedIn, and 70+ other sources

- AI-powered enrichment (finds email, phone, tech stack, etc.)

- Waterfall enrichment (tries multiple sources until data is found)

- GPT-powered personalization variables

Pricing: Free tier available; paid plans from $149/month

Best for: Teams that need deep, custom research at scale

The reality: Clay functions as an "AI research agent" for GTM teams. It's not a database itself—it orchestrates data from other sources and fills gaps with AI. Powerful but requires technical setup.

Category 2: AI Personalization & Research Tools

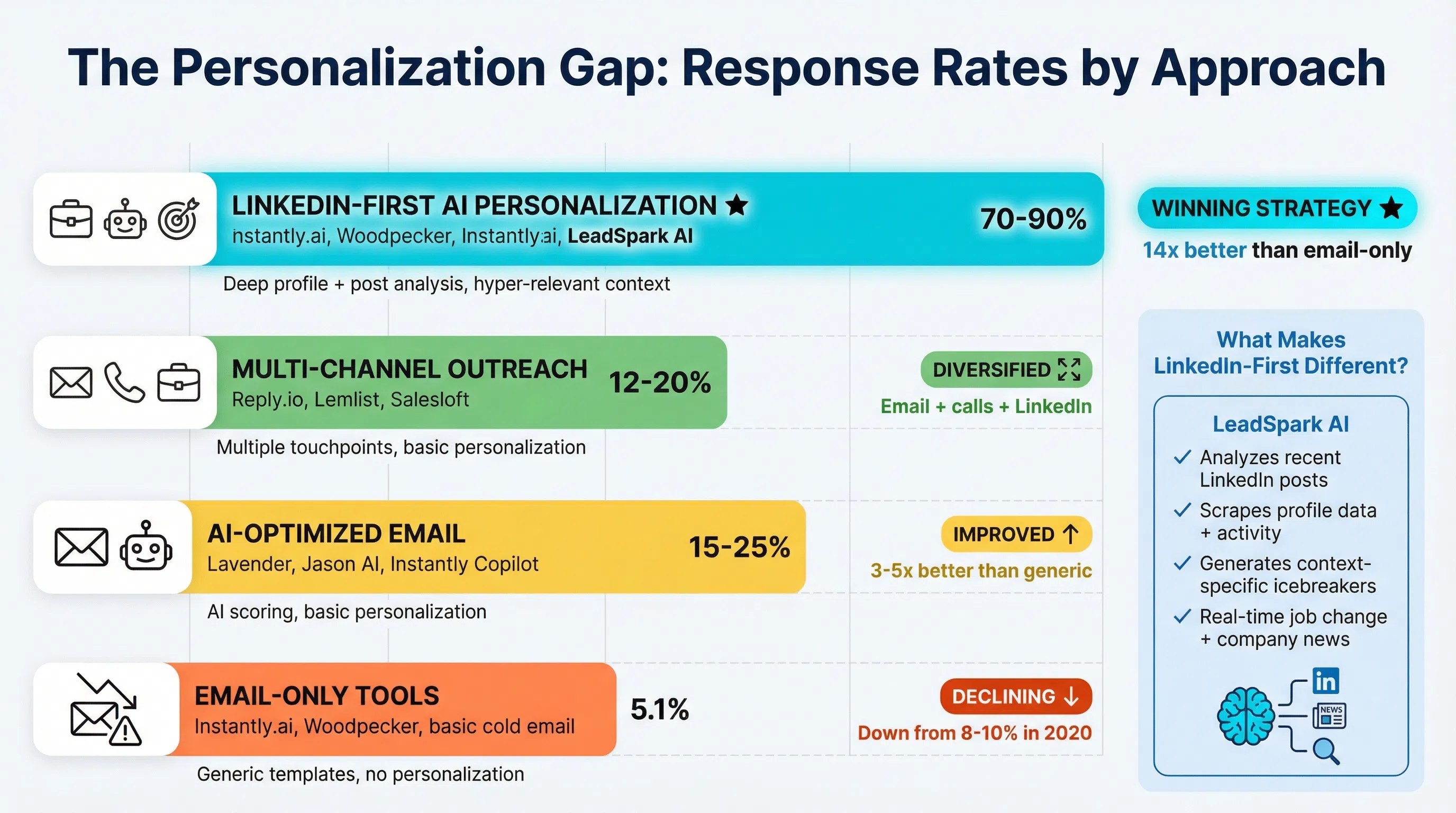

The competitive advantage in 2026. The best cold emailers hit 40-50% response rates by getting personalization right. AI makes that level possible at scale.

LeadSpark AI: Best for LinkedIn-First Personalization

What it does: AI-powered LinkedIn research and personalization that analyzes profiles, posts, and activity to craft hyper-relevant outreach.

Key features:

- Analyzes LinkedIn profiles, recent posts, and shared connections

- Generates personalized conversation starters (not generic templates)

- Multi-channel context (LinkedIn + email + calls)

- Real-time research on job changes, company news, posted content

Pricing: From $97/month

Best for: SDRs prioritizing LinkedIn outreach and relationship-building

The reality: While email-only tools deliver 5.1% response rates, LinkedIn-first approaches with deep personalization achieve 70-90% response rates because you're starting conversations based on what prospects actually care about. LeadSpark AI positions itself in the "personalization" category rather than trying to be an all-in-one tool.

Lavender: Best for Email Writing Optimization

What it does: AI email coach that scores and optimizes your emails in real-time.

Key features:

- Email scoring (0-100) based on reply likelihood

- Personalization suggestions based on prospect data

- Mobile preview and spam word detection

- Integrates with Gmail, Outlook, and sales engagement platforms

Pricing: Free tier available; $29/month for individual plan

Best for: SDRs who write a lot of custom emails

The reality: Lavender doesn't write emails for you—it coaches you to write better ones. Users report 25-40% higher response rates after optimizing with Lavender's suggestions.

Jason AI (Reply.io): Best for Prompt-Based Email Generation

What it does: AI assistant inside Reply.io that generates personalized cold emails based on prompts and prospect data.

Key features:

- Generate entire sequences from simple prompts

- Pulls prospect data to personalize at scale

- A/B testing suggestions

- Integration with Reply.io's engagement platform

Pricing: Included with Reply.io plans (from $60/month)

Best for: Teams using Reply.io who want AI-assisted email writing

The reality: Jason AI is good for generating first drafts, but you'll still need to edit for authenticity. It's best used for inspiration and scale, not as a "write it and forget it" solution.

Category 3: Sales Engagement Platforms (SEPs)

The workflow engine of your SDR motion. 66% of companies with $5M+ revenue use SEPs to streamline outreach and optimize sales velocity.

Outreach: Best for Enterprise-Grade Revenue Orchestration

What it does: Complete AI Revenue Workflow Platform with engagement, intelligence, and forecasting.

Key features:

- Multi-channel sequences (email, calls, LinkedIn, SMS)

- Kaia AI assistant (coaching, meeting notes, real-time content)

- Full-funnel reporting (activity to revenue)

- Deal and pipeline management

Pricing: Custom pricing; typically $100-150/user/month

Best for: Large sales organizations (50+ reps) with complex processes

The reality: Outreach offers better visibility for measuring ROI with full-funnel reporting. With 3,488 G2 reviews and a 4.3/5 rating, it's a market leader—but you need serious volume to justify the cost and complexity.

Salesloft: Best for All-in-One Sales Engagement

What it does: Revenue orchestration platform combining engagement, intelligence, conversation analytics, and deal management.

Key features:

- Customizable cadences across email, phone, LinkedIn

- Rhythm AI for buyer prioritization

- Conversation intelligence and call recording

- Seamless Salesforce integration

Pricing: Custom pricing; typically $100-125/user/month

Best for: Mid-market to enterprise teams (20-500 reps)

The reality: SalesLoft has 4.5/5 rating on G2 with 4,104 reviews. Users rave about the user-friendly interface and customizable cadences. However, it offers limited pipeline visibility compared to Outreach—you'll need to supplement with your CRM.

Reply.io: Best for Mid-Market Multi-Channel Outreach

What it does: Affordable multi-channel sales engagement platform with AI assistant.

Key features:

- Email, calls, LinkedIn, SMS, and WhatsApp sequences

- Jason AI for email generation

- Deliverability optimization and inbox rotation

- Built-in B2B database (160M+ contacts)

Pricing: From $60/month per user

Best for: Growing teams (5-50 reps) wanting enterprise features at mid-market pricing

The reality: Reply.io offers 90% of Outreach/Salesloft functionality at 50% of the price. The trade-off: slightly less polish and fewer advanced analytics. Still a solid choice for most mid-market teams.

Instantly.ai: Best Budget Email Automation

What it does: Email-only cold outreach platform with unlimited sending accounts.

Key features:

- Unlimited email accounts (for deliverability rotation)

- AI Copilot for email generation

- Email warmup and deliverability monitoring

- Simple, affordable pricing

Pricing: From $37/month

Best for: Solo SDRs or small teams focused purely on email

The reality: Instantly is email-only, which means you're missing LinkedIn, calls, and SMS—60-70% of the touchpoints that drive modern B2B deals. Great for pure email plays, but limiting for complex sales.

Category 4: AI SDR Agents (Autonomous Prospecting)

The future is here. AI SDR agents go beyond automation—they research, learn, adapt, and improve like human SDRs.

Agent Frank: Best for Autonomous Learning and Optimization

What it does: AI-powered sales agent that functions like a full-time SDR, continuously learning from campaigns.

Key features:

- Learns from successful campaigns and adapts messaging

- Refines targeting based on prospect responses

- Autonomous research and personalization

- Integrates with your existing tech stack

Pricing: From $499/month (billed quarterly)

Best for: Teams wanting to augment (not replace) human SDRs

The reality: Agent Frank continuously learns from your ICP and successful campaigns. It's not just sending emails—it's getting smarter about who to target and what to say.

Artisan (Ava): Best for End-to-End Outbound Automation

What it does: AI SDR agent named Ava that handles 80% of outbound tasks from research to follow-ups.

Key features:

- Automated prospect research and list building

- Initial outreach and multi-touch follow-ups

- Response handling and meeting booking

- Learning from your feedback

Pricing: Custom pricing; typically $750-2,000/month

Best for: Teams wanting to scale outbound without adding headcount

The reality: Artisan claims 80% task automation, but you'll still need human oversight. Think of Ava as a junior SDR that never sleeps—great for top-of-funnel volume, but still needs a human for complex deals.

Ema: Best for CRM-Integrated AI Outbound

What it does: AI Employee platform with dedicated AI SDR that runs end-to-end outbound and syncs to CRM.

Key features:

- Automatic lead finding and enrichment

- Hyper-personalized email writing

- Deliverability management

- Learns from results and pushes to CRM

Pricing: Custom pricing

Best for: Enterprise teams with complex CRM workflows

The reality: Ema runs outbound end-to-end with tight CRM integration. It's powerful but expensive—best suited for teams where SDR time costs more than the platform.

Category 5: Communication & Social Selling Tools

The human touch at scale. These tools help SDRs add personality and multi-channel reach.

LinkedIn Sales Navigator: Best for Account-Based Prospecting

What it does: Advanced LinkedIn search, lead tracking, and InMail messaging for B2B prospecting.

Key features:

- Advanced search filters (title, company size, geography, etc.)

- Lead and account alerts (job changes, company news)

- InMail credits for direct outreach

- CRM integration

Pricing: $99/month (Professional) or $149/month (Team)

Best for: Any outbound motion or account-based approach

The reality: "For any outbound GTM motion, Sales Navigator is a must-have". It's expensive with no real competitors for researching and engaging large buying teams. The ROI comes from finding the right people, not just any people.

Loom: Best for Personalized Video Outreach

What it does: Screen and camera recording for personalized video messages.

Key features:

- One-click screen + camera recording

- Shareable links with view tracking

- Custom thumbnails and CTAs

- Integrates with email and SEPs

Pricing: Free tier; $12.50/month for Business

Best for: SDRs adding video personalization to cold outreach

The reality: Personalized Loom videos can increase reply rates by 2-3x, especially for high-value prospects. The key: make it personal, not salesy. A 30-second custom video beats a generic email every time.

Aircall: Best for Cloud-Based Sales Dialing

What it does: Cloud phone system built for sales teams with advanced routing and analytics.

Key features:

- Click-to-dial from your CRM or SEP

- Call recording and analytics

- Power dialer and local presence

- Integrates with Salesforce, HubSpot, Outreach, etc.

Pricing: From $30/user/month

Best for: Teams making 50+ calls per day

The reality: Traditional phone systems suck for SDRs. Aircall integrates with your stack so you can dial from your SEP, auto-log to CRM, and analyze performance—all without leaving your workflow.

Category 6: Analytics & Conversation Intelligence

Turn conversations into revenue insights. Call recording became invaluable for SDRs, helping teams analyze conversations and improve training.

Gong: Best for Revenue Intelligence

What it does: Conversation intelligence platform that records, transcribes, and analyzes all customer interactions.

Key features:

- Automatic call recording and transcription

- AI-powered insights (talk-to-listen ratio, keyword tracking)

- Deal risk analysis and forecasting

- Coaching insights for managers

Pricing: Custom pricing; typically $1,200-1,600/user/year

Best for: Enterprise teams (50+ reps) focused on win rate optimization

The reality: Gong is the gold standard for conversation intelligence. It's expensive, but teams using Gong report 15-25% higher win rates by identifying what top performers do differently.

Chorus.ai (ZoomInfo): Best for Integrated Call Analytics

What it does: Conversation intelligence platform (owned by ZoomInfo) with call recording and analytics.

Key features:

- Call and meeting recording

- Automatic transcription and keyword tracking

- Integration with ZoomInfo data

- Deal and pipeline insights

Pricing: Custom pricing (bundled with ZoomInfo)

Best for: Teams already using ZoomInfo

The reality: If you're a ZoomInfo customer, Chorus is a natural add-on. Standalone, it's comparable to Gong but with tighter ZoomInfo integration for account context.

Tech Stack Recommendations by Company Size

Here's how to build your SDR tech stack based on team size and budget:

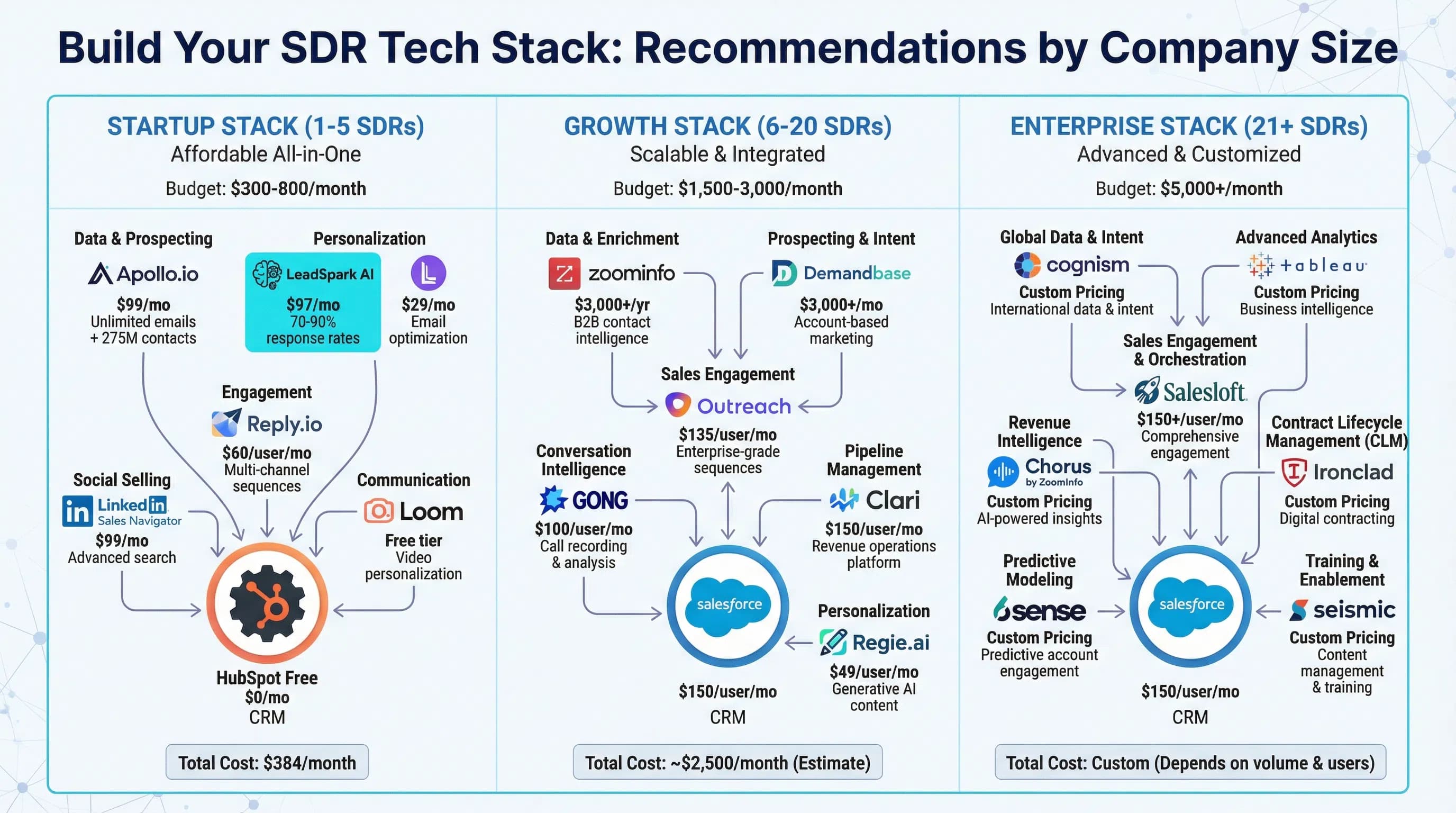

Startup Stack (1-5 SDRs) — $300-800/month

Focus: Affordable all-in-one tools that minimize complexity.

Recommended stack:

- CRM: HubSpot (free) or Close ($49/user/mo)

- Data & Prospecting: Apollo.io ($99/mo for unlimited emails)

- Personalization: LeadSpark AI ($97/mo) + Lavender ($29/mo)

- Engagement: Reply.io ($60/user/mo)

- Social Selling: LinkedIn Sales Navigator ($99/mo)

- Communication: Loom (free tier)

Total: ~$384-634/month for 1-2 users

Why this works: You get multi-channel outreach (email + LinkedIn), AI personalization, and video without breaking the bank. Apollo + Reply.io covers 80% of what Outreach does at 1/5th the price.

Growth Stack (10-30 SDRs) — $2,000-5,000/month

Focus: Specialized tools for each function with better data and analytics.

Recommended stack:

- CRM: Salesforce or HubSpot Pro

- Data & Prospecting: Apollo.io ($99/user/mo) or Cognism ($15K/year)

- Personalization: LeadSpark AI ($97-197/user/mo) + Lavender

- Engagement: Salesloft ($125/user/mo) or Reply.io ($60/user/mo)

- AI SDR Agent: Agent Frank ($499/mo) for top-of-funnel

- Social Selling: LinkedIn Sales Navigator Team ($149/user/mo)

- Communication: Loom Business + Aircall ($30/user/mo)

- Analytics: Gong or Chorus (if budget allows)

Total: ~$2,000-4,000/month for 10 users (without Gong)

Why this works: You're specializing—best-in-class tools for data, engagement, and personalization. The AI SDR agent (Agent Frank) augments your team for top-of-funnel volume.

Enterprise Stack (50+ SDRs) — $10,000-30,000/month

Focus: Enterprise-grade platforms with advanced analytics and tight integrations.

Recommended stack:

- CRM: Salesforce Enterprise

- Data & Prospecting: ZoomInfo ($30K-50K/year) + Cognism for EMEA

- Personalization: LeadSpark AI (enterprise) + Lavender

- Engagement: Outreach ($125/user/mo) or Salesloft ($100/user/mo)

- AI SDR Agents: Artisan + Ema for specialized motions

- Social Selling: LinkedIn Sales Navigator Team ($149/user/mo)

- Communication: Loom Business + Aircall

- Analytics: Gong ($1,200-1,600/user/year)

Total: ~$15,000-40,000/month for 50+ users

Why this works: You have the volume to justify enterprise pricing and the complexity that requires advanced orchestration (Outreach/Salesloft), deep intelligence (Gong), and intent data (ZoomInfo). AI agents handle repetitive top-of-funnel work.

How to Choose Your SDR Tech Stack

Don't just buy tools because they're popular. Follow this framework:

Step 1: Audit Your Current Process

- What's working? Don't replace tools that deliver ROI.

- Where are bottlenecks? Research? Personalization? Follow-up?

- What's your biggest problem? Low reply rates? Bad data? No pipeline visibility?

Start with your pain points, not vendor marketing.

Step 2: Define Your Channel Strategy

Email-first? Instantly, Lemlist, or Saleshandy (budget-friendly)

Multi-channel (email + calls + LinkedIn)? Reply.io, Salesloft, or Outreach

LinkedIn-first? Sales Navigator + LeadSpark AI for personalization

The reality: Email-only gets 5.1% response rates. Multi-channel gets 12-20%. LinkedIn-first with deep personalization gets 70-90%. Your channel strategy determines your stack.

Step 3: Prioritize Integration Over Features

The best tool is useless if it doesn't integrate with your CRM and workflow. Look for:

- Native CRM integration (Salesforce, HubSpot, etc.)

- SEP integration (if using Outreach/Salesloft)

- Two-way sync (data flows both directions automatically)

"While SDR tools are designed to streamline processes, too many tools can slow down the sales process". Integration reduces tool sprawl.

Step 4: Calculate True ROI, Not Just Cost

Don't compare pricing—compare cost per meeting booked.

Example:

- Tool A: $100/month, generates 5 meetings = $20/meeting

- Tool B: $500/month, generates 40 meetings = $12.50/meeting

Tool B is 5x more expensive but 60% cheaper per meeting. Think in outcomes, not price tags.

Step 5: Run Trials with Clear KPIs

Before committing, establish clear KPIs:

- Response rates

- Meeting booking rates

- Pipeline contribution

- Time saved per SDR

Then conduct trials with 2-3 top candidates. Measure what matters.

The Future of SDR Tech Stacks in 2026

Here's where the market is heading:

1. AI SDR Agents Will Augment (Not Replace) Human SDRs

AI agents like Agent Frank and Artisan handle top-of-funnel volume, freeing human SDRs for high-value conversations. Companies using AI see 30-50% faster pipeline growth.

2. LinkedIn-First Strategies Will Dominate

Email response rates continue declining (now 5.1% average). LinkedIn-first approaches with deep personalization deliver 70-90% response rates because you're starting real conversations, not blasting inboxes.

3. Data Quality > Data Quantity

"I would break the bank on data if I had to" — clean data is the foundation. Expect more teams investing in premium data (ZoomInfo, Cognism) and AI enrichment (Clay) over cheap, inaccurate lists.

4. Multi-Channel Orchestration Becomes Standard

Email-only tools are dying. The future is coordinated sequences across email, LinkedIn, calls, SMS, and video—all triggered by AI-powered signals (intent, job changes, funding events).

5. Conversation Intelligence for Everyone

Gong and Chorus were enterprise-only. Now, platforms like Avoma and Fireflies bring conversation intelligence to SMBs at $20-40/user/month. Every SDR will have call analytics by 2027.

FAQs

What is an SDR tech stack?

An SDR tech stack is the collection of software tools Sales Development Representatives use to find prospects (data tools), personalize outreach (AI personalization), orchestrate multi-channel sequences (engagement platforms), communicate (calls/video/social), and measure performance (analytics). A modern stack typically includes 5-15 tools depending on company size.

How much should an SDR tech stack cost?

Startups (1-5 SDRs): $300-800/month total

Growth companies (10-30 SDRs): $2,000-5,000/month

Enterprise (50+ SDRs): $10,000-30,000/month

The key is cost per meeting booked, not total spend. A $500/month tool that generates 40 meetings ($12.50/meeting) beats a $100/month tool generating 5 meetings ($20/meeting).

What's the difference between a sales engagement platform and a CRM?

Your CRM (Salesforce, HubSpot) is your database of record—it stores all customer and prospect data. A Sales Engagement Platform (Outreach, Salesloft, Reply.io) orchestrates your outreach workflows—multi-channel sequences, automation, and activity tracking. They integrate: SEP runs your outreach, CRM stores the results.

Do I need an AI SDR agent if I have human SDRs?

AI SDR agents (Agent Frank, Artisan, Ema) augment, not replace human SDRs. Use them for top-of-funnel volume (research, initial outreach, qualification), freeing your human SDRs for high-value conversations and complex deals. Teams using AI agents report 30-50% faster pipeline growth because humans focus on what humans do best: building relationships.

Is LinkedIn Sales Navigator worth $99-149/month?

Yes, if you're doing outbound B2B sales. Sales Navigator is a "must-have" for any outbound motion because it offers advanced search, account alerts (job changes, funding), and InMail for direct outreach. The ROI comes from finding the right people with the right context—not just volume.

Should I use an all-in-one tool or best-of-breed stack?

All-in-one (Apollo.io, Snov.io): Better for small teams (1-10 SDRs) on limited budgets. You get 80% of the functionality at 50% of the cost with less complexity.

Best-of-breed (ZoomInfo + Salesloft + Gong): Better for larger teams (20+ SDRs) with complex processes and budget for specialization. Each tool excels at one thing, giving you the best results per category.

Most teams start all-in-one and graduate to best-of-breed as they scale.

What are the best free SDR tools?

- CRM: HubSpot (free tier with unlimited contacts)

- Data: Apollo.io (free tier with limited credits)

- Personalization: Lavender (free tier for basic scoring)

- Video: Loom (free tier for up to 25 videos)

- Call recording: Fireflies.ai (free tier for transcription)

You can build a functional starter stack for $0-200/month using free tiers + affordable paid tools (Reply.io at $60/user/mo).

How do I measure SDR tech stack ROI?

Track these KPIs:

- Response rates: % of outreach getting replies (target: 15-30%)

- Meeting booking rate: % of outreach turning into meetings (target: 5-10%)

- Pipeline contribution: $ value of opportunities created (target: 5-10x tool cost)

- Time saved: Hours saved per SDR per week (calculate hourly SDR cost)

Calculate cost per meeting: Total monthly tool cost ÷ meetings booked. Optimize for lowest cost per meeting, not lowest tool price.

Build Your Winning SDR Tech Stack

The modern SDR tech stack isn't about having the most tools—it's about having the right tools that integrate seamlessly and drive measurable results.

Key takeaways:

- Start with your channel strategy: Email-first, multi-channel, or LinkedIn-first determines your stack

- Invest in data quality: Clean data is the foundation—don't skimp here

- Choose integration over features: The best tool is useless if it doesn't fit your workflow

- Measure cost per meeting, not just tool cost

- Add AI where it augments humans: Personalization (LeadSpark AI), SDR agents (Agent Frank), analytics (Gong)

If you're prioritizing LinkedIn-first prospecting with hyper-personalized outreach, try LeadSpark AI — achieving 70-90% response rates by crafting conversations based on what prospects actually care about, not generic templates.

Sources:

- Best AI SDR Tools for 2026 - Snov.io

- 10 Best AI SDR Tools Actually Tested - Fundraise Insider

- SDR Tools: Top Tech Stack for B2B Sales Teams - Prospecta

- 12 SDR Tools to Drive More Sales - Cognism

- The Ultimate List of 12 SDR Tools - Artisan

- The Modern Sales Tech Stack - Highspot

- Apollo.io vs ZoomInfo Comparison - Fundraise Insider

- Apollo.io Pricing vs Alternatives - SalesIntel

- Cognism vs ZoomInfo - Cognism

- Best Apollo.io Alternatives - Cognism

- 8 Best AI Email Personalization Tools - Saleshandy

- Best AI Sales Outreach Tools - ZoomInfo

- Outreach vs Salesloft Comparison - Outreach

- Outreach vs SalesLoft Analysis - Forecast

- Salesloft Reviews 2026 - G2

- 11 Sales Prospecting Tools - Avoma

- Top 11 AI Sales Tools - Default

- 7 Best Outbound Sales Automation Tools - Ema

Ready to Generate Personalized Icebreakers?

Join sales professionals using LeadSpark AI to create hyper-personalized LinkedIn icebreakers in minutes.